See here for Personal Income Tax Deadlines

Corporate Income Tax is a tax payable on a company’s income. Companies resident in South Africa pay tax on their worldwide income, while non-resident companies pay tax on South African sourced income only.

In practical terms, a company’s net profit per their financial statements is adjusted for additional amounts allowable or disallowable for tax purposes to arrive at taxable income. Corporate Tax is currently at a flat rate of 28% of taxable income. Taxable capital gains need to be calculated and 66.6% of the gain is added to taxable income therefore the effective tax rate on capital gains is 18.65%.

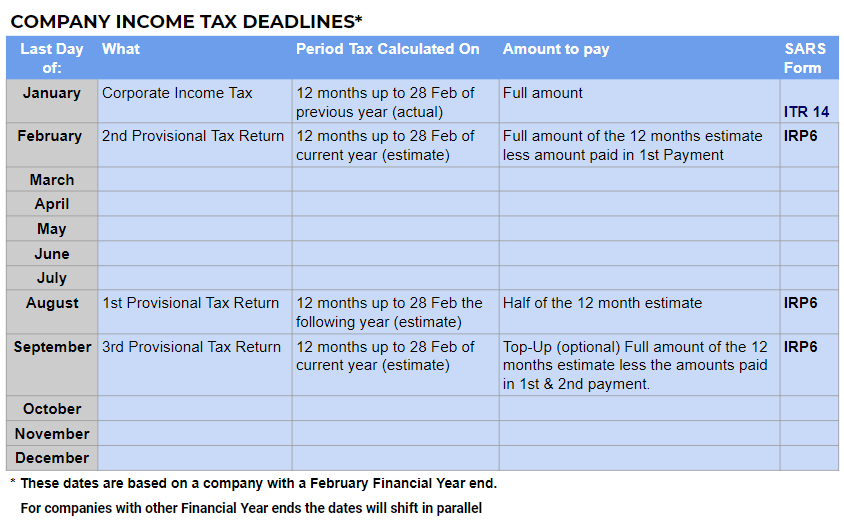

Companies must submit an annual return (ITR14) which includes copies of annual financial statements and a tax calculation for the financial year. Once assessed any tax payable must be paid within the period specified in the SARS notice. They must also submit three provisional tax returns (IRP6’s) during the financial year which include an estimate of the taxable incomes for the periods. Payment of any tax due must accompany the returns. It is recommended that all companies register with SARS eFiling where the annual tax return form (ITR14) and the provisional tax return form (IRP6’s) are generated and can be submitted online.

This can also be handled on your behalf by your auditor or accountant who should be registered tax practitioners.

Companies that meet certain requirements may request to be assessed as a “small business corporation” (SBC) in terms of section 12E of the Income Tax Act. Being classified as such has benefits in terms of accelerated depreciation allowances and meaningful concessionary tax rates which work on a sliding scale.

The Corporate Income Tax annual return form (ITR14) contains a question asking taxpayers if they meet the requirements of an SBC, and this triggers further questions which will determine if the company will be assessed as an SBC for that year of assessment or not. A major requirement is that the company’s annual turnover must be less than R20 million. Other requirements and further details on Small Business Corporation Tax in South Africa.

Key dates for SBC’s are the same as for corporate income tax.

For those who register, Turnover Tax is applicable to micro businesses (available to sole proprietors, partnerships, companies and CC’s) with turnovers of R1 million or less. Registration is manual and a registration form (TT01) must be submitted to a SARS branch. The turnover tax system replaces income tax, provisional tax, capital gains tax and dividend tax. It is worked out by applying a tax rate to a micro business’s turnover on a sliding scale.

Dividend Tax is a tax on the dividends paid to the beneficial owners of shares by any company that is a South African tax resident or a foreign company whose shares are listed on a South African exchange.

It is a withholding tax and is withheld from dividend distributions and paid to SARS by the company or administrator who pays the dividend. See SARS guide on dividends tax.

It should be noted that the recipient remains liable for the tax if it is not withheld and paid over. The current tax rate is 20%.

However some recipients, including local companies, public benefit organisations, pension, provident, retirement and similar funds, are exempt from the tax. It is important to note that while “group companies” and entities that administer dividends are automatically exempt, other potentially exempt recipients have to notify the body paying the dividend of their status prior to payment of the dividend. A declaration form, provided by the entity who pays the dividend, needs to be completed and submitted to them.

Individual taxpayers should include the net amount of dividends received where withholding tax was deducted as “amounts considered non-taxable” in the “exempt local and foreign dividends” box on their tax return.

Foreign dividends received by individuals from foreign companies (if recipient’s shareholding is less than 10%) are taxed as normal income (not dividend tax) at a maximum effective rate of 20%, but there are some exemptions. See SARS guide on dividends tax For details of this tax.

Payment of the tax withheld to SARS by the entities who deducted it, must be made by the last day of the month following the month in which the dividend was paid.

Businesses are required by SARS to deduct a withholding tax from payments made to foreigners for:

The tax must be paid over to SARS and is currently 15% for all the above. In the case of royalties and interest there are some exemptions, but where these relate to the status of the payee declarations must be made to the payer. Details of these withholding taxes are available on the SARS website.

An employer is required to register for PAYE and UIF and, if the employer expects that total salaries will be more than R500,000 over the next twelve months, for SDL.

One registration with SARS can serve for all tax types.

The employer is required to deduct PAYE and the employee’s portion of the UIF contribution (currently 1%) from salaries. The employer needs to add a company contribution to the amount of the UIF deducted (currently a further 1%) and also make an SDL contribution (currently 1%).

The employer needs to submit a monthly declaration form (EMP201) summarising the PAYE and UIF and SDL contributions together with a payment to SARS.

The employer also needs to submit two reconciliations (EMP 501) (in respect of the EMP 201’s submitted and payments made) per annum together with tax certificates (IRP5’s /IT3(a)s)

SARS updates the employee data base with the tax certificates.

The reconciliation declarations and certificates can be completed and submitted using Sars eFiling (up to a maximum of 50 tax certificates) or online using e@syFile Employer software which uses the efiling user name and password. The latest e@syFile version is available on the eFiling website (www.sarsefiling.co.za).

See step-by-step guide for EMP 501 reconciliations.

It’s worth noting that most payroll systems handle all the above for employers. For smaller businesses it is normally worth outsourcing the payroll function.