Article by listed Accountant COLLEEN JAICH

Without a roadmap, a business may flounder from lack of a clearly defined view of the future. A business plan sounds rather complicated, but is actually quite simple. You don't have to hire an expensive consultant to write it. If you as an entrepreneur had a great idea for starting up a business in the first place, then you are the right person to compile a business plan. Here are some suggested items to include:

Business information & Background

Business contact details, names of owners/directors/shareholders and their ID numbers plus all registration numbers if available (SARS and CIPC). Write a short narrative about your business. How did it get started and what is it all about.

Vision & Mission

A Vision is a short and concise statement about where you want your business to go in the long term. A great example is Bill Gates who wanted see a personal computer in every home. A Mission statement on the other hand is a summary of how you are going to achieve your vision. It may also include a list of your core business values

Marketing plan

Define your target market and identify the demographics, age groups, tastes and preferences. Describe your plans for building a brand to promote your business. Include a step by step specification of how you intend using the social and print media for this purpose.

Budgets

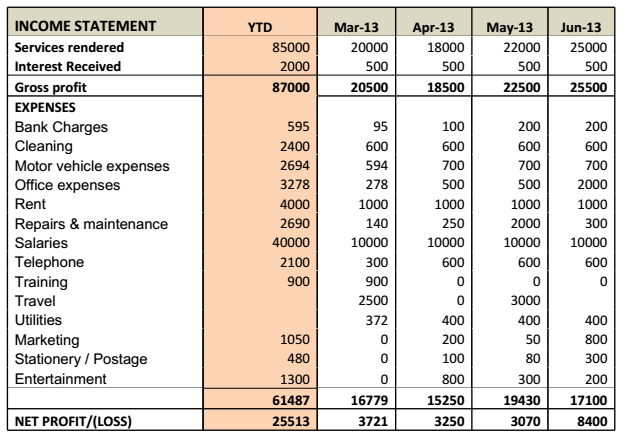

A financial plan is a pivotal point for a business plan and as such you need to spend some time on this section. Compile an Income Statement showing your budgeted income for the next year less expected costs for running the business. Add a budgeted Balance Sheet showing the net profit or loss from your Income Statement plus any expenditure on Capital, such as furniture and equipment, and balance this amount out with the amount of money you need to invest in the business.

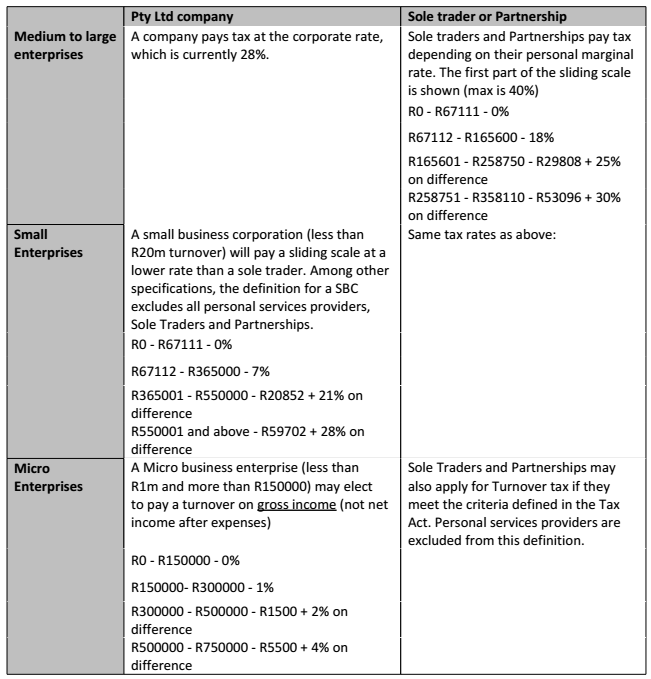

The first thing entrepreneurs think of when starting up a business is whether to register a company or operate as a sole trader. This decision has long-term implications on the business as both forms of ownership carry their respective pros and cons. One of the most important difference is the tax legislation as per the table below:

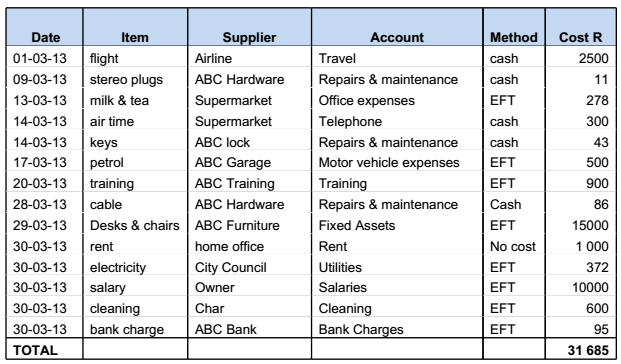

Many new businesses fail due to administrative chaos. From day one, record your transactions in some written form, whether it be an old-fashioned black ledger or a cloud-based accounting package. Using Google Docs or Excel are probably the most convenient ways of keeping track of your income and expenses, since both are quite accessible on the web or pre-installed onto laptops and tablets. The transaction sheet can easily be converted to an Income Statement and Balance Sheet using a Macro. Here is an example of a simple transaction sheet which can be converted into an Income Statement:

4. CASHFLOW VERSUS PROFIT

Keeping track of your cash flow is just as important as knowing your profit. Many new business owners don't understand the difference between the two and end up with cash flow problems. Your net profit is the difference between your income and expenses for a period usually measured in a calendar month. However, the balance in your bank account may differ from this figure for many reasons including the most common ones:

Most start-up companies have restricted cash flows or tight budgets which prevents them from employing a full time Accountant. Fortunately, the solution to this problem is simple due to the vast number of independent Accounting firms offering specialist financial services. Outsourcing your accounting functions has numerous benefits, depending on the level of expertise required. The large Auditing firms offer a range of excellent services, but their fees could be quite prohibitive to a small enterprise. Smaller Accounting firms are more affordable, but could offer restrictive services. Whatever your choice, it's a good idea to meet with your prospective Accountant(s) in person before appointing them. Once you have made your decision, ensure that you have a written agreement with your Accountant setting out your mutual requirements and expectations. After that it's a matter of establishing a personal relationship with your Accountant. Remember that he or she can be a invaluable asset to your business.